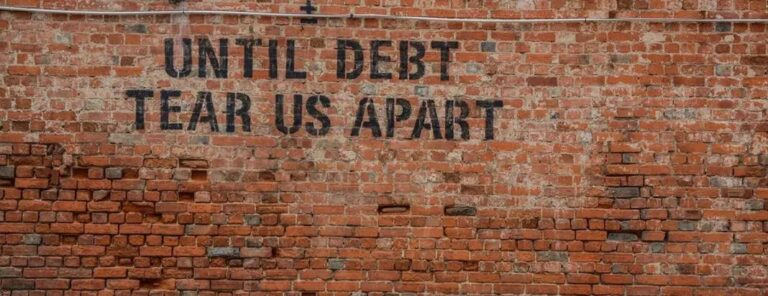

In just a few short weeks, you can accumulate a lot of debt. This includes medical bills, utility bills and revolving cards. Debt isn’t exciting, and it’s easy to understand why. When the deadline for repaying the loan approaches, and there is no solution in sight, it can cause sleeplessness. The good news is you don’t need to worry about your debt. You may find that a simple financial technique known as Debt Consolidation is the best solution. Here’s everything you need to learn about it. Continue reading to learn more.

Debt consolidation

What is debt consolidation?

Debt consolidation is the process of obtaining a new loan in order to pay off existing consumer debts or liabilities. Ideal loan types are unsecured . Interesting, many companies offer consolidation loans. These companies can consolidate all of your small debts into a single loan, and then you get a loan for the entire amount. The loan conditions and terms are generally more favorable than the previous loans. Depending on the loan agreement, debt consolidation loans often come with a lower monthly payment, lowered interest rates and a longer repayment period.

Who can consolidate a debt?

You can consolidate your student loans, credit cards, and more. You can contact your credit union or credit card company to learn more about the debt consolidation offers they have. If you have a good payment history with your financial institution and a great relationship, then you can get incredibly helpful advice quickly. If your financial institution rejects you, then private lenders or mortgage companies may be a good option. Many lenders will lend money as long as they meet their basic requirements. Some companies also offer debt consolidation services. They have the experience and tools to fund your debts, and make sure you can pay back your loans without stress.

Is debt consolidation a form of debt amnesty or forgiveness?

Remember that consolidation of debts does not cancel your original debt. The loan is sent to another lender or covered by another loan. For those who are not eligible for debt consolidation, you may want to consider debt settlement or actual debt relief. You can also combine debt settlement and a consolidation loan to quickly pay off your existing loans. Debt settlement aims to reduce a consumer’s debt obligations, and not the number creditors. Debt relief services or credit counseling help you renegotiate existing debt terms in order to make repayment easier.

+ There are no comments

Add yours